Irs Qualified Dividends And Capital Gain Tax Worksheet

The qualified dividends worksheet is found on the back of page 2 in the 1040 instructions booklet just above the schedule 1 form 1040 line 9b amount worksheet. The Forms 1040 and 1040A therefore help investors to take advantage of lower capital gains rates without having to.

Capital Gains Tax Worksheet Promotiontablecovers

Use Part IV of Schedule D of Form 1041-N US.

Irs qualified dividends and capital gain tax worksheet. Before completing this worksheet complete Form 1040 or 1040-SR through line 11b. Qualified dividends and the capital gain tax worksheet is a good way to estimate the capital gain taxes. Stick to the fast guide to do Form Instructions 1040 Schedule D steer clear of blunders along with furnish it in a timely manner.

IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. So for those of you who are curious heres what they do. The box on line 13 of Schedule 1.

W-2 input forms that support up to 4 employers for each spouse. If you received capital gain distribu-tions as a nominee that is they were paid to you but actually belong to some-. Income Tax Return for Electing Alaska Native Settlement Trusts as a worksheet to figure the 2018 tax on qualified dividends or net capital gain.

The corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax for a small number of taxpayers. SSA-1099 input form to record Social Security Benefits. Qualified dividends and capital gain tax worksheet 2020 2020-2021 Online solutions help you to manage your record administration along with raise the efficiency of the workflows.

Qualified Dividends and Capital Gain Tax Worksheet. Foreign Earned Income Tax Worksheet. With a good understanding of the mechanics preparers can spot opportunities to advise clients to take advantage of.

See the Instructions for Form 1041-N at wwwirsgovForm1041N for more information. Schedule D Tax Worksheet. If there is an amount in box 2d in-clude that amount on line 4 of the 28 Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D.

Foreign Earned Income Tax WorksheetLine 16. Formore information on IRS Free File and e- le seeFree Software Options for Doing Your Taxes in these instructions r go to oIRSgovFreeFile. Qualified dividends or a net capital gain for 2018.

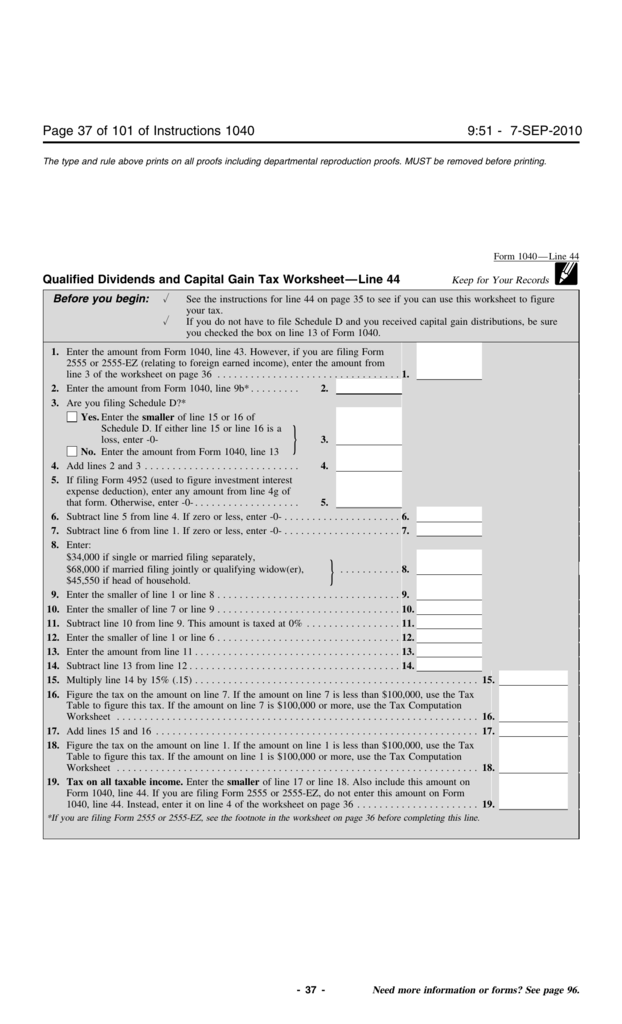

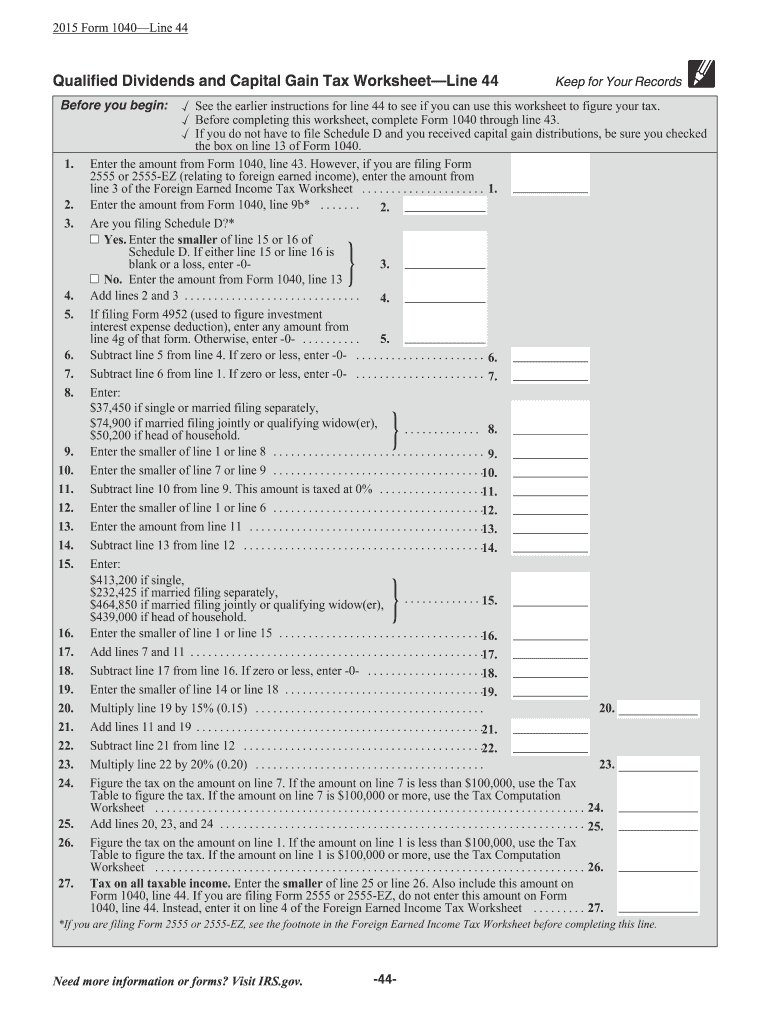

Qualified Dividends and the Capital Gain Tax Worksheet download. Complete lines 5 through 25 following the worksheet instructions. Line 44 Qualified Dividends and Capital Gain Tax Worksheet.

Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4e or 4g even if you dont need to file Schedule D. Keep for Your Records. Child Tax Credit and Credit for Other Dependents.

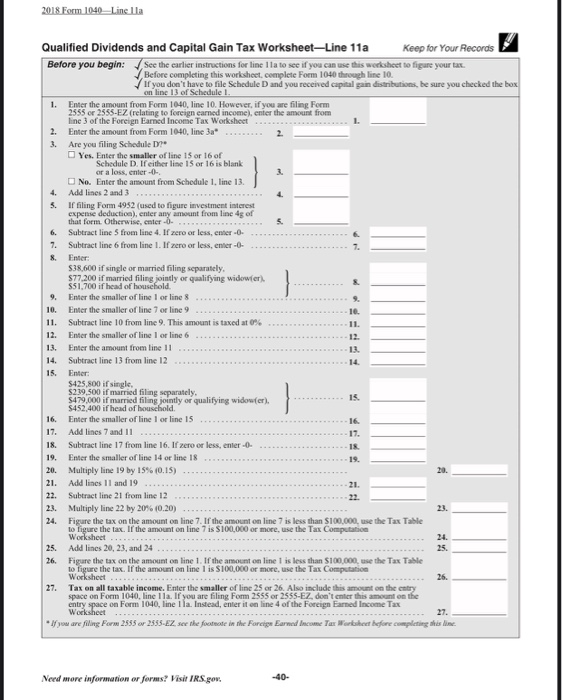

Qualified Dividends and Capital Gain Tax WorksheetLine 11a. It is also one of the most often utilized as it contains a lot of info thats vital when filing federal. Enter the amount from Form 1040 line 10.

IRS Departmentofthe Treasury InternalRevenue Service IRSgov is the fast safe and free way to prepare and e- le your taxes. The amount of qualified dividends used in the calculation of additional 10 tax withholding or alternative minimum tax is also shown on this worksheet. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax.

Enter the amount from line 25 of this Qualified Dividends and Capital Gain Tax Worksheet on line 15 of Form 8615 and check the box on that line. In those instructions there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet which is how you actually calculate your Line 44 tax. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax.

The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV that were received from mutual funds other regulated investment companies or real estate investment trusts. However the capital gain taxes were increased after 2017 which became profitable for the government. IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003.

This is actually the biggest class of forms in IRS. Qualified Dividends and Capital Gain Tax Worksheet. The 27 lines because they are so simplified end up being difficult to follow what exactly they do.

Qualified Dividends and Capital Gain Tax Worksheet. Line 52 Child Tax Credit Worksheet. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax.

Before completing this worksheet complete Form 1040 through line 10. Exclusion of Gain on Qualified Small Business QSB Stock later. On Form 1040 or 1040-SR line 6.

Most taxpayers who file Schedule D do not have amounts on line 18 which contains capital gain taxed at the 28 rate or. Qualified Dividends and Capital Gain Tax WorksheetLine 16. It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations Form 1040 Instructions 2013 p.

Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR line 16 or in the instructions for Form. Lines 64a and 64b Earned Income Credit EIC Six additional worksheets round out the tool. See What s New in these instructions.

1099-R Retirement input forms for up to 4 payers for each spouse. Form 8862 who must file. Use the childs filing status to complete lines 6 13 23 and 24 of the worksheet for Form 1040.

Before completing this worksheet complete Form 1040 through line 10. Taxpayers must still use Schedule D if any amount is reported in box 2c 2d 2e or 2f of Form 1099-DIV or in certain cases.

Qualified Dividends And Capital Gains Worksheet

Qualified Dividends And Capital Gain Tax Worksheet Line 44

Capital Gains Tax Worksheet Promotiontablecovers

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 Fill Online Printable Fillable Blank Pdffiller

Capital Gains And Losses U S Department Of Treasury Free Download

Capital Gains Tax Worksheet Nidecmege

Completed Qualified Dividends And Capital Gain Worksheet 2017 Form 1040line 44 Qualified Dividends And Capital Gain Tax Worksheetline 44 Keep For Course Hero

Irs 2555 Forms Photos Of Best Qualified Dividends And Capital Gain Tax Worksheet Models Form Ideas

How Your Tax Is Calculated Understanding The Qualified Dividends And Capital Gains Worksheet Marotta On Money

2011 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller

Qualified Dividends And Capital Gains Worksheet 2019

Capital Gains Tax Worksheet Worksheet List

2019 Form 1040 Qualified Dividends And Capital Gain Tax Worksheet 2021 Tax Forms 1040 Printable

Qualified Dividends And Capital Gains Worksheet 2021

Capital Gains Tax Worksheet Nidecmege

Qualified Dividends And Capital Gains Worksheet

Review Alexander Smith S Information And The W2 Chegg Com